And for individuals whose ordinary income tax rate is below 12% to 35%, qualified dividends are taxed at 15%, and for those in the 10% or 12% tax brackets, they pay no tax on qualified dividends. If a company with a history of consistently rising dividend payments suddenly cuts its payments, investors should treat this as a signal that trouble is looming. For example, if a company issues a stock dividend of 5%, it will pay 0.05 shares for every share owned by a shareholder. Providing access to our stories should not be construed as investment advice or a solicitation to buy or sell any security or product, or to engage in or refrain from engaging in any transaction by Forbes Advisor Australia.

The relationship between dividends and market value

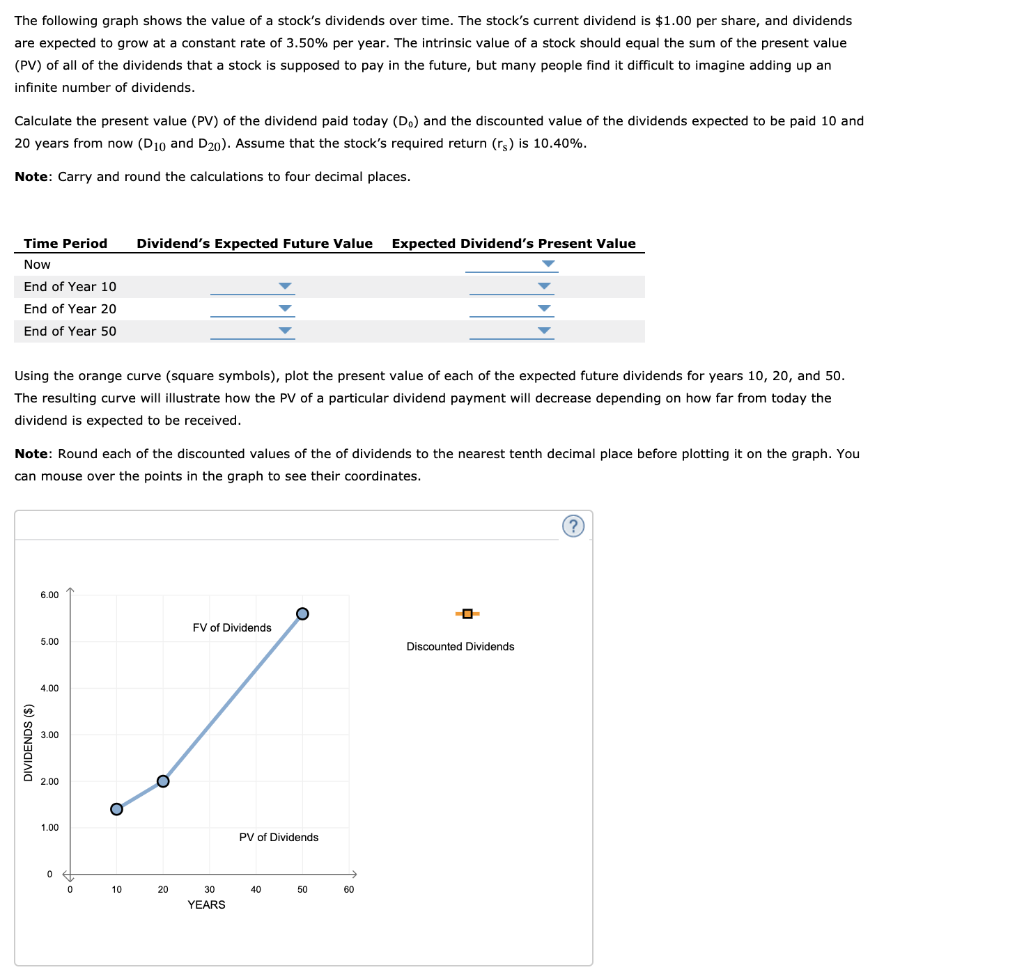

Tax is another important consideration when investing in dividend gains. Investors in high tax brackets often prefer dividend-paying stocks if their jurisdiction allows zero or comparatively lower tax on dividends. For example, Greece and Slovakia have a lower tax on dividend income for shareholders, while dividend gains are tax exempt in Hong Kong. Dividends are a payout to shareholders in the form of either cash or additional shares on every share they hold. A shareholder must have purchased a stock by a certain date to be eligible to receive the next dividend. For example, company HIJ has five million outstanding shares and paid dividends of $2.5 million last year; no special dividends were paid.

How Do Dividends Affect a Stock’s Share Price?

- Based on that dividend, you expect to receive $240 in dividends the first year.

- While a company having a high dividend yield is usually positive, it can occasionally indicate that a company is financially ailing and has a depressed stock price.

- Companies can also issue non-recurring special dividends, either individually or in addition to a scheduled dividend.

- The dividend payout ratio reveals the percentage of net income a company is paying out in the form of dividends.

When a company issues additional stock shares for any reason, the result is stock dilution. More shares in circulation means a reduction in the earnings per share (EPS) of the existing shares, and in the ownership percentage held by each current shareholder. ETFs are another pooled investment security that can help you diversify your investments, but they’re traded on the stock exchange like shares.

Example of Stock Dividend Dilution

If most competitors are investing heavily to increase capacity or innovate cutting edge products, paying too much in dividends — thereby not investing enough in the future — can result in losing market share. Dividend payments are the primary method companies share their profits with stockholders. Numerous investors rely on dividends for their living expenses and construct a stock portfolio primarily to maximize their dividend income. Dividend payments increase demand for a stock and consequently result in a higher stock price. Dividend payments also send a strong message to the investor community and boost the confidence of potential buyers.

The Effects of Dividend Policies on Stock Prices

The stock might trade at $63 one business day before the ex-dividend date. On the ex-dividend date, it’s adjusted by $2 and begins trading at $61 at the start of the trading session on the ex-dividend date, because anyone buying on the ex-dividend date will not receive the dividend. Before we begin describing the various policies that companies use goods and services definition to determine how much to pay their investors, let’s look at different arguments for and against dividend policies. A company may cut or eliminate dividends when the economy is experiencing a downturn. Suppose a dividend-paying company is not earning enough; it may look to decrease or eliminate dividends because of the fall in sales and revenues.

Why do Companies Pay Dividends?

Many people invest in certain stocks at certain times solely to collect dividend payments. Some investors purchase shares just before the ex-dividend date and then sell them again right after the date of record—a tactic that can result in a tidy profit if it is done correctly. So, instead of rewarding shareholders through capital appreciation, the company began to use dividends and share buybacks as a way of keeping investors interested. The plan was announced in July 2004, nearly 18 years after the company’s IPO.

The cash distribution plan put nearly $75 billion worth of value into the pockets of investors through a new 8-cent quarterly dividend, a special $3 one-time dividend, and a $30 billion share buyback program spanning four years. If a company issues a 5% stock dividend, it would increase its number of outstanding shares by 5%, or one share for every 20 shares owned. If a company has one million shares outstanding, this would translate into an additional 50,000 shares. A shareholder with 100 shares in the company would receive five additional shares.

It could be monthly, quarterly, annually or a sporadic ‘special’ payment. Publicly traded companies listed on the Australian Securities Exchange (ASX) that offer dividends tend to pay twice a year, following full and half-year earnings announcements. Between commissions, taxes, and downward adjustments for dividend payments, it’s not easy to profit from dividend-capture strategies. Keep this in mind the next time you consider buying and selling stocks for the sole purpose of nabbing dividend payments. Therefore, a stable dividend payout ratio is commonly preferred over an unusually big one. A good way to determine if a company’s payout ratio is a reasonable one is to compare the ratio to that of similar companies in the same industry.

All stock dividends require an accounting journal entry for the company issuing the dividend. This entry transfers the value of the issued stock from the retained earnings account to the paid-in capital account. A stock dividend is a payment to shareholders that consists of additional shares of a company’s stock rather than cash. If you’re using share trading platforms to self-manage your portfolio you can easily purchase individual shares in companies that pay dividends.

Shareholders cannot demand dividends if the board decides to suspend them. Unpaid creditors and suppliers, on the other hand, can sue the company and even force it into bankruptcy. If a firm is paying dividends, you can assume that it anticipates no difficulties honoring other payment obligations. As such, dividend payments improve investor confidence and increase the demand for the stock.

The latter applies if they are qualified dividends that meet certain requirements. The dividend yield provides a good basic measure for an investor to use in comparing the dividend income from his or her current holdings to potential dividend income available through investing in other equities or mutual funds. When companies display consistent dividend histories, they become more attractive to investors. As more investors buy in to take advantage of this benefit of stock ownership, the stock price naturally increases, thereby reinforcing the belief that the stock is strong. If a company announces a higher-than-normal dividend, public sentiment tends to soar. Though dividends are not guaranteed on common stock, many companies pride themselves on generously rewarding shareholders with consistent—and sometimes increasing—dividends each year.