Finished inventory differs from raw materials and work in progress (WIP) inventory. While raw materials are the inputs used in production, and WIP refers to partially assembled items, finished goods are the final product. When I was an inventory manager at D-Wave, a Canadian electronics company, our manufacturing process comprised dozens of steps to ensure finished goods came out flawless. The status of finished goods inventory—including on-hand stock levels and storage locations—is tracked by an inventory manager or warehouse manager. All types of inventory are reported as current assets on the balance sheet. However, identifying finished goods helps determine how much of your inventory accounts are short-term assets and can soon be expected to generate profit.

Carpentry – Detached One or Two-Family Dwellings – All Operations to Completion

This classification includes making and erecting forms, placing reinforced steel and stripping forms. The employer will set up the “foundation forms,” pour concrete into the forms and then level the concrete smooth. These “foundation forms” are usually small wood barriers that hold the cement into the form for whatever the employer is making. Self-bearing floors are self-supported concrete floors elevated above ground.

Should you carry extra stock of finished goods inventory?

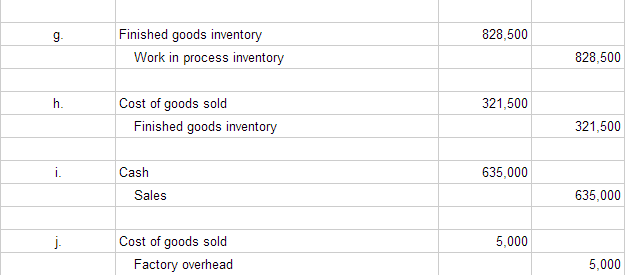

Calculations may need to be done in order to determine if the pull will be successful or not prior to installing the cable in the conduit. Lubricants that are specifically used for pulling cable through the conduits, are used to lubricate the cable at the time it is being pulled and also the conduit in some cases to assist with achieving a successful pull. This classification also applies to employers engaged in the installation of cable in subways. For example, with the job order costing, the manufacturing company ABC has completed a job with the goods that cost $30,000 during the month.

The Importance of Calculating Finished Goods Inventory

- Use manufacturing analytics to monitor key metrics such as inventory turnover, sales trends, and product performance.

- Many of these products are made to the customers’ specifications and require installation operations.

- Work performed by a subcontractor that becomes part of the finished product is considered exempt production work.

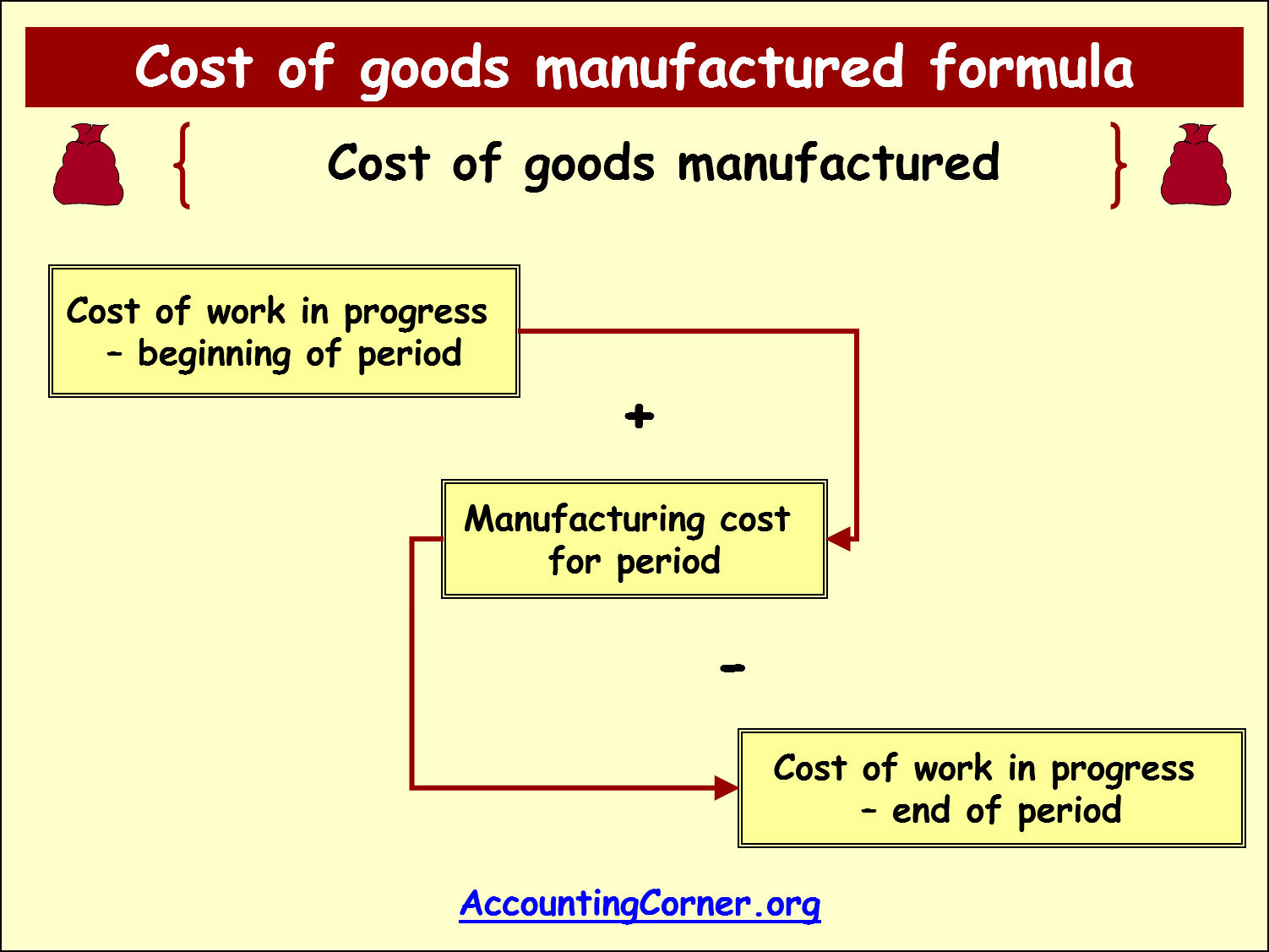

During the quarter, they produce additional smartphones valued at $8,000,000 (COGM) and sell devices worth $7,500,000 (COGS). Let’s say a small clothing manufacturer starts with $20,000 worth of finished inventory at the beginning of the month. During one month, they produce additional apparel worth $50,000 (COGM), and they sell $45,000 worth of goods (COGS). Finished goods inventory are items that have already been created or assembled and are ready to be sold.

When products are described as finished goods inventory, we can infer that they’ve completed the manufacturing process and are ‘waiting’ to be sold. Finished goods are goods that have been completed by the manufacturing process, or purchased in a completed form, but which have not yet been sold to customers. Goods that have been purchased in completed form are known as merchandise.

Seeing a breakdown of your inventory costs can potentially reveal opportunities to optimize operations and lower costs. In this stage, raw material inventory has been purchased but still sits untouched in the warehouse. In manufacturing corrugated cardboard used for the containers, heavy paper stock is fed into a corrugating machine which forms the corrugation “ripples.” An outer facing sheet layer is then glued to one or both sides.

Use inventory management software to track inventory levels in real time, manage orders, and forecast demand. Finished goods inventory includes products that have been fully manufactured and are ready to be sold. Unlike raw materials, the basic inputs for production, or work-in-process (WIP) inventory, which are still finished goods accounting being made, finished goods are the final products just waiting to be shipped to customers. Finished goods inventory consists of products that have completed the manufacturing process but have not yet been sold to customers. These goods are ready for sale and are accounted for as an asset on the balance sheet.

Code 5645 applies to employers engaged in all carpentry work in connection with the construction of detached one or two-family dwellings. Code 7536 applies to employers engaged in installing cable in conduits or subways. The installation of cable in conduits involves pulling the cable through the conduit. Several factors are taken into consideration before the cable is pulled through the conduit such as the size of the conduit, size and weight of the cable, tension requirements and jamming possibilities.

Recognizing that revenue requires recognizing the COGS—because COGS considers the materials and labor costs applied to each unit sold. Understanding finished goods inventory isn’t just good-practice accounting—it’s also good-practice inventory management. By assigning costs to these items based on the materials, labor, and overhead costs incurred to get this to this stage, I calculate that my work-in-process inventory value is $8,000.

Finished goods inventory is a broad category that can be broken down into other subcategories. Not all companies do that but when sales increase, it’s important to have proper business processes to answer the increased demand. Implementing the following subcategories of finished goods might be a good starting point in that regard. One manufacturer’s finished goods inventory may be a retailer’s merchandise inventory, dropshipping inventory, or another manufacturer’s raw material or component. The destination of these finished goods determines their classification after completion.